A Chancellor College economist Ronald Mangani has torn apart the recent economic reforms put in place by the Joyce Banda administration, arguing they are reminiscent of a government under panic and pressure. These reforms have received a warm welcome from many quarters.

But Finance Minister Ken Lipenga defended the reforms as long overdue, arguing that the situation which the current administration found itself in was not ideal.

The economist, Ronald Mangani, made the observation in Blantyre on Friday during a dinner and dance Standard Bank organised for its private banking customers.

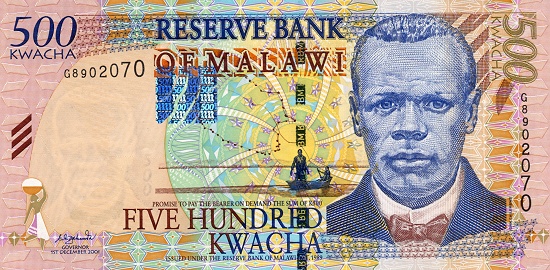

Mangani faulted the current regime for devaluing the currency and instantaneously floating it, a development which has seen the kwacha jumping from K167 in April to around K285.

“When the IMF first recommended a devaluation they provided a calendar of how it could happen, including the fact that it should be eventually, not instantaneously, followed by floatation. Unfortunately we have combined the two and have done many other things.

“For instance, we have removed subsidies on utilities including electricity and pump prices of fuel to be able to meet the expectations of the more liberal market that is consistent with the neo-liberal policies and neo-liberal Gospel of the Washington consensus,” said Mangani.

He observed that the country has abandoned the zero deficit budget, an occurrence he argued that people may conclude that Malawi has realistically admitted that the country cannot run without development partners.

“In my opinion the recent reforms that have just been implemented are reminiscent of a government under panic and under pressure. Some of the panic and pressure are obviously externally founded. We had to do everything possible to have a programme with IMF.

“But at the same time some of these reflect the way in which some economists in this country and other professionals, who are cousins of the economists, look at how things should be done believing that a very liberal economy is what we need at the moment. I do believe there is no economy in the world that is completely liberal,” said Mangani.

He observed that there is no economy in the world that has literally no subsidies on the private sector and that does not recognise that there will be a segment of the population that will not be able to effectively participate in the market.

“One of the contentious issues in the liberalization of the agriculture sector is the fact that the West is unable to remove subsidies on its farming community while at the same time, we find it contentious to extend subsidies to our domestic farming for the reason that subsidies lower the costs of production and would create even competition between domestically produced products and foreign produced agriculture products,” Mangani said.

He also took a swipe at the exchange rate reforms arguing they are not sustainable arguing that he did a paper for the African Economic Research Consortium on ‘The Effects of the Monetary Policy on Prices in Malawi’ whose two major findings support the assertion.

“The first is that if you look at monetary policy as the manipulation that the central bank does to the bank rate, the liquidity reserve requirement and money supply through open market operations, then monetary policy is ineffective.

“There is no causal relationship between the bank rate and goods prices on the market in Malawi. There is even no causal relationship between money supply and prices in Malawi which means the celebrated Quantity Theory of Money does not hold,” said Mangani.

He noted that the study revealed that the exchange rate is the single most important variable in influencing prices in the country.

“You tamper with the exchange rate, you tamper with prices. You induce what is called imported inflation or cost-push inflation because the cost of raw materials and intermediate inputs as well as the final product, given the significant role the distribution sector of the economy does at the moment,” said Mangani.

The study, according to Mangani, indicated that monetary policy is ineffective and that exchange policy is the most important tool in the local economy.

“One would say isn’t exchange rate not part of the monetary policy? Not in this context. We have what is referred to as the Exchange Rate Channel of Policy Transmission Mechanism which would exist if the manipulation of the central bank to the bank rate and money supply would be transferred to prizes through the exchange rate.

“But that’s not the case now. What happens in our country is that you change the exchange rate, that will instantaneously lead to changes in prices. You change the bank rate, it does not speak to the exchange rate. So you can’t talk about the Exchange Rate Channel of Policy Transmission Mechanism,” said Mangani.

He added that devaluing the kwacha will not necessarily lead to a decrease in imports and an increase in exports as others may think because the country’s imports and exports are not responsive to changes in the exchange rate.

He said the country’s imports are dominated by necessities such as fuel, pharmaceuticals, fertilizer and other farm inputs as well as raw materials and intermediate inputs which still have to be brought into the country regardless of the price.

On the other hand, Mangani said people do not expect Malawi to export more tobacco just because it has devalued the currency.

But Lipenga said government moved in with the reforms the way it did to avoid the economy from collapsing.

He added that the environment the Joyce Banda administration found itself in on April 7 2012 was not ideal.

“I haven’t seen his presentation but what I can say is that the reforms were long overdue and delaying them even further could have worsened the situation,” said Lipenga.