Below Is a Time Frame of Bitcoin and The Groups That Have Purchased the Digital Currency

Published on November 9, 2021 at 11:47 AM by Robert Ngwira

Bitcoin has been around for a long time, and various individuals have engaged in the network for multiple reasons throughout time. The author has made some changes to this page. Mainstream pundits sometimes dismiss people who acquire bitcoin as foolish victims of a fictitious bubble in which they believe they are investing. However, if we look more closely, we can track the history of bitcoin and its increasing acceptance via the advent of various types of purchasers. A different story about bitcoin’s worth has brought each group together, and it is these groups and narratives have progressively contributed to bitcoin’s long-term development. Before we move any further in our guide, please register yourself on the Bitcoin trading and learn to take your oil trading game to the next level by using this oil trading application.

The Idealists Group

Bitcoin creates a small group of cryptographers known as “cypherpunks” who were attempting to address the “double spend” issue that digital money was experiencing: “cash” stored in a digital file could easily duplicate and then spent multiple times. Bitcoin was the result of their efforts. However, the cryptographic community desired something more similar to real cash: private, untraceable, and not reliant on third parties like banks.

As an alternative to current electronic money systems such as credit cards, he said that bitcoin would be better because it would provide advantages such as eliminating chargebacks to retailers and reducing transaction costs.

The Libertarians Group

However, from the beginning, Satoshi Nakamoto promoted bitcoin to a libertarian audience as well. He did so by emphasizing the lack of any central authority and, more specifically, bitcoin’s independence from both governments and existing financial institutions, among other things. Also highlighted was the privacy of bitcoin transactions, which he described as “more or less secure” from the prying eyes of governments. Libertarians have been ardent supporters and purchasers of bitcoin, mainly as an act of self-determination rather than for financial gain. They have maintained a significant amount of influence in the Bitcoin community.

The Houlding Group

Because of this, they got used to large price swings and often advocated “HODLing” bitcoin (a misuse of the word “hold,” which operates in a now-famous message made by an intoxicated user determined to resist repeated “sell” comments from day traders). Half-jokingly, the HODLers said that bitcoin was headed “to the moon!” and expressed interest in purchasing “lambos” (Lamborghinis) with their profits in bitcoin.

Individual speculators, drawn to bitcoin prices by their volatility and price peaks, make up the fourth category of investors. Those who trade bitcoin daily, or day traders, seek to profit from the volatility of the cryptocurrency’s price by buying and selling often to capitalize on short-term price changes. Like speculators in every other asset, speculators in gold have no genuine interest in the big picture or questions of intrinsic worth, but only in the price at writing. These are the only storylines, with the words “buy” and “sell” often used to influence the market.

On the other side, some people are attracted to the stock market by reports of price bubbles. Ironically, bubble tales in the media, sometimes intended to scare away investors, may have the opposite impact. A “beauty contest” is what these investors are participating in — they aren’t concerned with long-term or intrinsic worth, but just with what other people may be willing to pay for bitcoin in the short- to medium-term future, as described by Keynes.

The Balancers of The Portfolio

When tales of bitcoin’s worth as a valuable component of a broader financial portfolio began to emerge, the cryptocurrency started to draw the attention of more experienced investors. These investors purchase bitcoin to protect themselves against more general dangers in the financial system.

The Enthusiasts from The Company

Most recently, the continued upward development of bitcoin’s price plateaus and market value has begun to make it more appealing to institutional investors and financial institutions. As a result, some top executives at a handful of major companies have made large-scale bitcoin purchases to keep in their portfolios as part of its overall asset allocation strategy. As a result, they become more appealing to investors who want some exposure to bitcoin but are hesitant to purchase it directly – or who are legally prohibited from buying it, such as certain mutual funds – as a result.

Plagiarism Report:

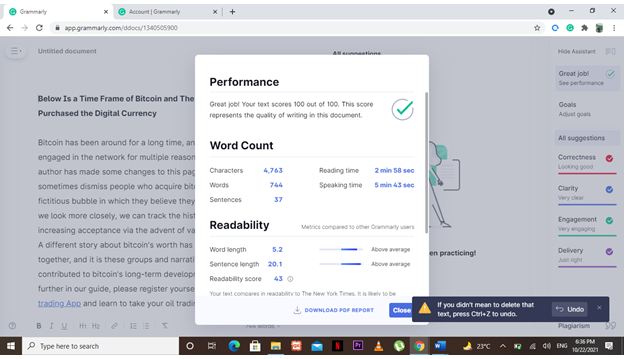

Grammarly Report: