by: Lameck Masina

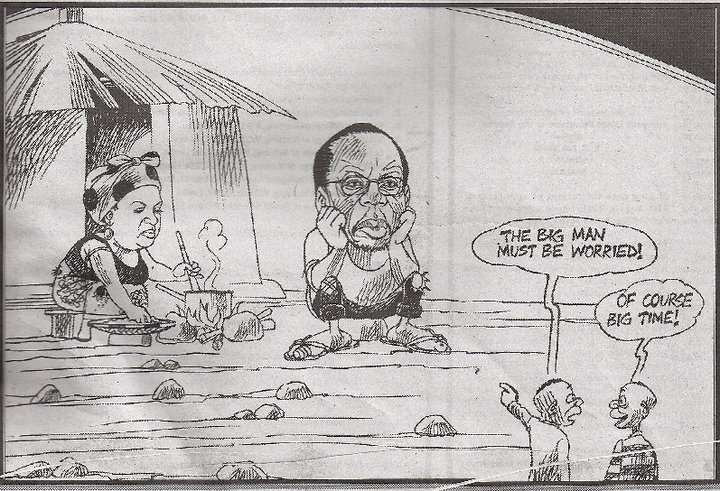

Blantyre – Malawi economists and International Monitory Fund (IMF) officials are pressuring Malawi president to devalue the local currency Malawi Kwacha (MK) so that it moves in line with market forces, but Mutharika is refusing to bulge. Currently Malawi kwacha is officially trading at MK151.80 to US$1 while on the parallel market is going at MK190 to a dollar. Economists say this has brought problems in the country’s which is currently facing acute shortage of forex with people accused of holding the foreign currencies in anticipation to make a kill out it once the kwacha has been devalued. The forex shortage had resulted into the recurrent fuel crisis that has hit Malawi since September last year as importers have been unable to purchase the commodity from outside countries. Recently the government and the IMF failed to successfully complete a second review of the Extended Credit Facility (ECF) programme due to the Malawi’s reluctance to liberalize the foreign exchange regime.

The development threatens future budgetary support as the country’s key donors said they would use a positive review from the IMF as a yard stick for the release their aid. Economist have warned that this will also have a direct impact on the country’s economy because, they say, although government has introduced a zero-deficit budget, it will still need donors and development partners funding for the implementation of some developmental projects. Officials of the Reserve Bank of Malawi (RBM) the country’s central bank which is legally mandated to control and implement the country’s monetary policies have been reluctant to give their official stand on the devaluation call. RBM spokesperson Ralph Tseka told a local radio station, Capital FM last week that the authorities was not in a position to comment anything ‘on the ongoing debate’ but the ‘decision will be made public soon’

However president Mutharika an economist by professional said in his state of nation address last week that come rain or sunshine he will never devalue the local currency. “Devaluating the Kwacha will result into a lot of problem to the ordinary Malawian because this will result in rise in prices of all goods and services” Mutharika said. Mutharika asked IMF officials to come up with a solution to what would happen after devaluation of the Kwacha. “Unless IMF tell me how to address the problem I will not accept devaluing the Kwacha.” He also said should Malawi devalue its currency these will only foreigners who he alleged are holding forex to release it once the Kwacha has been devalued. But IMF resident representative Ruby Randall said concerns raised by Malawi government over the consequences of devaluation can be addressed. “We have been saying that IMF programs would accommodate a decision by the Malawi authorities to increase fuel and kerosene subsidies to those most in need on temporary and limited basis”, she said.

She also said that could also avoid the so called consequences of the devaluation if it improved on the farm input program to the needy Malawians so that they should continue having bumper harvests. Commenting on the issue a columnist to the Malawi News, a weekly newspaper Steven Nhane compared the effects of devaluation on the poor Malawians to the effects of curative drug on the patients. He said medical prescriptions are always bitter but the beauty of it is that its bitterness does not take long. “That is what devaluation of the Kwacha it expected to do. You swallow the bitter pill, to cure the ailment, once and for all”, he said. A local economist Charles Chanthunya has warned that ‘poor’ economic policies which Malawi is implemented would likely aggravate the current economic crisis. He said there is a strong need to even float the Kwacha arguing that just devaluating or fix it would solve the problem.Malawi last devalued its currency in 2009 from MK142 to a dollar to the current MK151.80 to a dollar.