latest research has established that Paladin Africa, owners of the famous Kayelekera Uranium mine in Karonga did not declare 350 thousand pounds of uranium oxide in their uranium exports for the year 2012.

The research by African Forum and Network on Debt and Aid and the Malawi Economic Justice Network says the quantity is worth 18 million dollars which is about K6.6bn.

The report by MEJN and AFRODAD titled The Revenue Costs and Benefits of foreign Direct Investment in the Extractive Industry in Malawi-The case of Kayelekela Uranium Mine also finds that too many powers invested in the president to discuss and approve mining deals, has compromised transparency and accountability in management of the sector.

The study has been conducted since June of 2011.

Paladin Africa Manager responsible for operations Mr. Greg Walker while asking for more time to see the report described the finding on 350 thousand pounds of undeclared uranium oxide as rubbish.

He told zodiak online in an interview that, before any uranium export is made, officials from the department of mines must examine and certify the products.

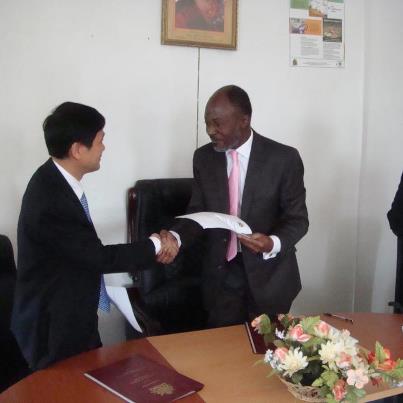

At the launch of the report in Lilongwe Thursday, African Forum and Network on Debt and Development AFRODAD executive director Dr. Collins Magalasi, reiterated that the Kayelekera deal was unfairly reached and as such renegotiation is the only way out.

“We must renegotiate this deal, and there should be no question that this will scare investors, no way” he said.

He further added: “DRC has re-negotiated 60 mining deals, and yet no investor has left that country”.

His counterpart MEJN’s executive Director Dalitso Kubalasam said “the country is miles away from making the most from Kayelekela and the mining industry in general.”

The report also outlines how Malawi has failed to maximise on revenue gains from the mine. The company was exempted from many taxes at the signing of the deal.

For instant, Government is devoid of the 17.5 percent Value added Tax on all of the company’s imports for a period of 15 years which is also the whole life span of the mining deal.

At the signing of the deal during the Bingu wa Mutharika regime in 2007, an agreement was reached that the company will paying 1.5 percent in royalties for the first 3 years. This is against the 5 percent minimum stipulated in the Mines and Minerals Act of 1981.

According to the study, “Malawi has lost 1.3 billion kwacha between 2009 and April 2012 due to the reduction in royalties”.

The report has also highlighted a weakness in the country’s legal systems governing the mining industry. This is another loophole through which investors are exploiting the country’s mineral resources.

For instance, it costs only 1 thousand kwacha to get a mining exploration licence.

Relevant Government authorities have yet to comment on the report asking for time to see the report.

Again according to the report, Malawi has no legislation to regulate Controlled Foreign Companies, as is the case with Paladin Africa which is one of the many subsidiaries of Paladin Energy based in Australia.

This weakness, the report confirms, gives more room for exploitation and gives room for transfer pricing.

The report makes several recommendations among them that, all Uranium be sold in Malawi as is the case with tobacco, that government increase its ownership of the mine beyond the current 15 percent shareholding against Paladin’s 85 percent and that the 10 year stabilization period where Paladin enjoys certain concessions must be reduced.—Zodiak Online

No comments! Be the first commenter?